MHA Dodd-Frank Certification free printable template

Get, Create, Make and Sign frank dodd certification form

Editing how to dodd certification online

How to fill out dodd certification form

How to fill out MHA Dodd-Frank Certification

Who needs MHA Dodd-Frank Certification?

Video instructions and help with filling out and completing frank form download

Instructions and Help about dodd frank certification form pdf

The following are dogs that you're going to need to fill out that are going to be sent to the lender in addition to the other documents that I requested from you previously they're going to have an RMA which is request for a low modification in affidavit a 40 50 60 but dodd-frank certificate and of course a hardship letter which you're going to be filling out and now go over in another episode how to fill out our hardship letter you can download these forms and making home affordable govern also get them on our website at Robert Donna com including PNL worksheets blank rental agreements and also this slide presentation on a PDF format at Robert l don'tMTTR com we can help you fill these forms out and give you a pre-qualification if you want at no expense and this presentation just so you know an instructional video only applies to owner occupied properties, but you can also use this video and information for non-owner occupied homes it's just pretty tough to get a little modification for a non-owner occupied home, but you could still use this information towards trying to obtain in one of those type of loan modifications also so let's get to the documents okay, so this is what's called The Making Home Affordable program request for modification and affidavit is this is the actual loan modification application you're going to be filling out and again the previous information you gather in the previous video it's going to give you the information you're going to need to properly fill this out obviously you're going to need your loan ID number that's why you need your mortgage statements your service so if your Bank of America EMC Wells Fargo whoever it is you want to put your service in here it's important to put your loan number and your service I also want to put your full name the name as it appears on your loan mod loan application okay make sure you put your social security number your date of birth your home phone number with an error code and I would personally put my cell phone number on here because if they're trying to get a hold of you're not always going to be at home, and you know getting them to call you back it's like hitting the lottery in many cases so be kind of cool to have your cell phone number on there that way if they need to get a hold of you they can Single just call you on your cell phone you can pick it up at any time here's the coal borrow information on your right-hand side so anyone who is also on the loan used to go on here your co-borrower social security number date of birth home phone number with area code and our cell phone number if they want to do that now here's's a little area here where talks about keeping the property versus selling it if you definitely want to keep the property say that you want to keep the property because in many situations the lenders what they want to do is they'd rather sell your property and if you're telling them right now they'd rather sell the property, but you would consider low...

People Also Ask about dodd frank certification form

What is a Dodd-Frank form?

Who does Dodd Frank apply to?

What are the key points of the Dodd-Frank Act?

What are the five areas included in the Dodd-Frank Act?

What are the five areas included in the Dodd Frank Act?

What does the Dodd-Frank Act apply to?

Who has to comply with Dodd-Frank?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify dodd frank certification without leaving Google Drive?

How do I edit frank certification form online?

How do I edit dodd frank form blank on an Android device?

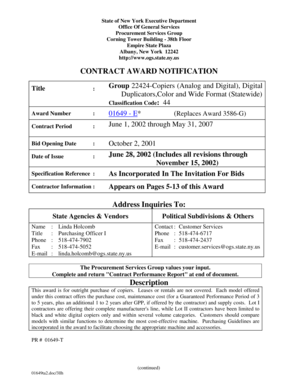

What is MHA Dodd-Frank Certification?

Who is required to file MHA Dodd-Frank Certification?

How to fill out MHA Dodd-Frank Certification?

What is the purpose of MHA Dodd-Frank Certification?

What information must be reported on MHA Dodd-Frank Certification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.